Navigate Complexities With Innovative Tax Obligation Services and Efficient Tax Planning

As tax guidelines become increasingly intricate, the need for innovative tax solutions and effective tax planning has never been much more essential. What ingenious approaches are really making a distinction in today's intricate tax landscape?

Understanding Tax Obligation Rules

(Tax Planning)Navigating the complex landscape of tax obligation guidelines is vital for people and services alike. A detailed understanding of these regulations can significantly influence financial health and conformity. Tax obligation regulations are subject to frequent modifications, requiring stakeholders to remain notified about brand-new arrangements, deductions, and credit histories that may affect their tax obligation obligations.

Trick components of tax obligation guidelines include earnings tax, company tax obligation, sales tax obligation, and residential property tax obligation, each regulated by distinct guidelines and obligations. People must understand individual exceptions, basic reductions, and eligibility for numerous tax credit histories, whereas businesses must comprehend the ramifications of business framework on tax obligation duties, including pay-roll taxes and estimated tax obligation settlements.

(Frost PLLC)

Advantages of Innovative Tax Solutions

Often, organizations and individuals take advantage of ingenious tax solutions that leverage progressed modern technology and tactical planning to boost their overall tax obligation administration. These solutions use cutting-edge software program and analytics to streamline tax processes, guaranteeing precision and conformity while minimizing the risk of mistakes. Automation of regular tasks not just saves time however additionally enables tax obligation specialists to concentrate on higher-level strategic campaigns.

Furthermore, innovative tax solutions use individualized remedies customized to the specific requirements of clients. By integrating data from various sources, experts can give comprehensive insights that help clients make educated decisions regarding their tax obligation obligations. This all natural method promotes a much deeper understanding of one's financial landscape, making it possible for positive planning and prospective tax obligation savings.

Furthermore, these solutions often include real-time surveillance and coverage, which enhances openness and enables for timely modifications in reaction to altering tax obligation regulations. The ability to remain ahead of compliance needs is crucial in today's dynamic tax obligation atmosphere. Eventually, the combination of innovation and calculated insight settings clients to browse intricacies better, causing optimized tax results and better total financial wellness.

Trick Methods for Reliable Tax Obligation Planning

Reliable tax obligation preparation is vital for both individuals and companies intending to enhance their financial results. One key technique is to comprehend and utilize tax obligation reductions and debts properly. Recognizing eligible deductions can substantially lower gross income, while credit reports directly lower tax obligations.

Another essential method is to preserve arranged financial documents throughout the year. This practice not just simplifies the preparation procedure during tax obligation season however also makes sure no important reductions or credit reports are neglected.

In addition, engaging in aggressive tax preparation entails forecasting revenue and expenses. By preparing for fluctuations, individuals and organizations can make educated choices concerning tax-saving chances, such as timing revenue recognition or profiting from losses in low-income years.

Furthermore, leveraging pension and tax-advantaged financial investment vehicles plays a vital duty in lessening tax obligation direct exposure - Tax Planning. Contributions to accounts like Individual retirement accounts or 401(k) s can supply instant tax advantages while securing long-lasting financial savings

Lastly, seeking expert recommendations can intensify the effectiveness of tax methods. Tax obligation specialists have the knowledge to browse complicated guidelines and recognize possibilities customized to specific financial situations. Executing these strategies can bring about boosted economic security and development.

Leveraging Innovation in Tax Administration

In today's digital age, companies and individuals alike can significantly improve their tax management processes by leveraging modern technology. Advanced software program remedies make it possible for customers to automate information access, thus reducing human error and conserving beneficial time. Cloud-based systems enable for real-time partnership between clients and tax obligation experts, making sure that all stakeholders are immediately updated on tax obligation responsibilities and liabilities.

Moreover, expert system (AI) and artificial intelligence algorithms can analyze substantial quantities of financial information to determine potential reductions and credits that may have been neglected. These innovations not just streamline the tax preparation process yet also provide understandings that help in making enlightened monetary choices throughout the year.

In addition, electronic filing systems boost compliance by making sure entries are exact and timely, while audit-tracking functions can monitor modifications and flag disparities. Security is vital; as a result, utilizing encrypted software application remedies protects sensitive monetary info from cyber risks.

Last but not least, leveraging technology in tax monitoring cultivates an aggressive approach, allowing companies and people to expect tax obligation implications and plan accordingly. By adopting these ingenious devices, stakeholders can browse the intricacies of tax laws better, ultimately leading to better financial outcomes.

Study: Success Stories

Several companies have transformed to ingenious tax solutions and planning approaches to enhance their economic outcomes. By involving a specific tax obligation specialist, they carried out a detailed tax preparation strategy that consisted of determining available credit scores and reductions.

In addition, a not-for-profit organization leveraged innovative tax solutions to browse complicated tax-exempt condition needs. By view website functioning with tax specialists that comprehended the subtleties of not-for-profit taxes, they effectively kept their tax-exempt status and optimized their financing possibilities. These success tales show the extensive influence that tactical tax preparation and ingenious services can carry a diverse variety of organizations and companies.

Verdict

In verdict, navigating the complexities of tax obligation laws necessitates the fostering of innovative tax obligation services and effective tax obligation planning. By leveraging sophisticated technology and proactive strategies, people and organizations can optimize their economic outcomes, ensuring conformity while minimizing mistakes. The combination of automation and cloud-based systems boosts collaboration with tax obligation specialists, eventually bring about considerable tax cost savings and improved financial health. Accepting these techniques is vital for achieving a lasting and efficient tax monitoring strategy.

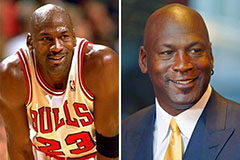

Michael Jordan Then & Now!

Michael Jordan Then & Now! Hailie Jade Scott Mathers Then & Now!

Hailie Jade Scott Mathers Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Kane Then & Now!

Kane Then & Now!